Certainty in risk mitigation

One unified account view that scores, triages, verifies, and learns from every document.

Holistic risk visibility

Comprehensive account risk summaries

Deliver clear account level risk summaries from all submission documents and external feeds.

Aggregate signals from loss runs, policies, supplements, and external records into one risk snapshot.

Highlight gaps and inconsistencies so nothing undermines your decision.

Provide underwriters with concise conclusions and supporting evidence.

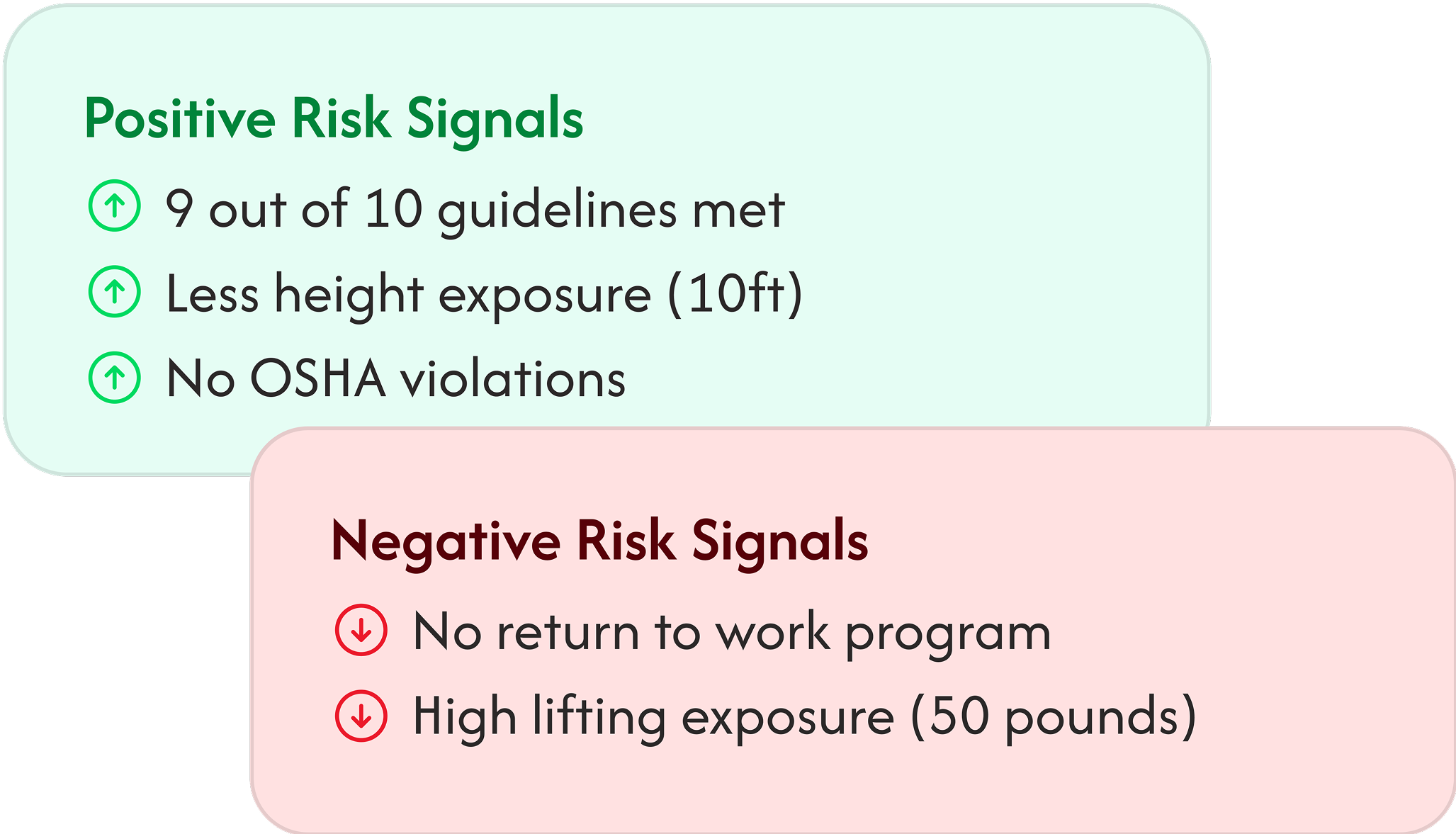

Focus on the right alerts

Positive and negative risk indicators

Flag guidelines-aligned positive indicators to spotlight favorable exposures.

Flag negative indicators to surface areas needing deeper review.

Rank signals by relevance to your underwriting rules.

Highlight patterns that drive smarter decisions.

Deliver clear rationale for each indicator so decisions remain explainable.

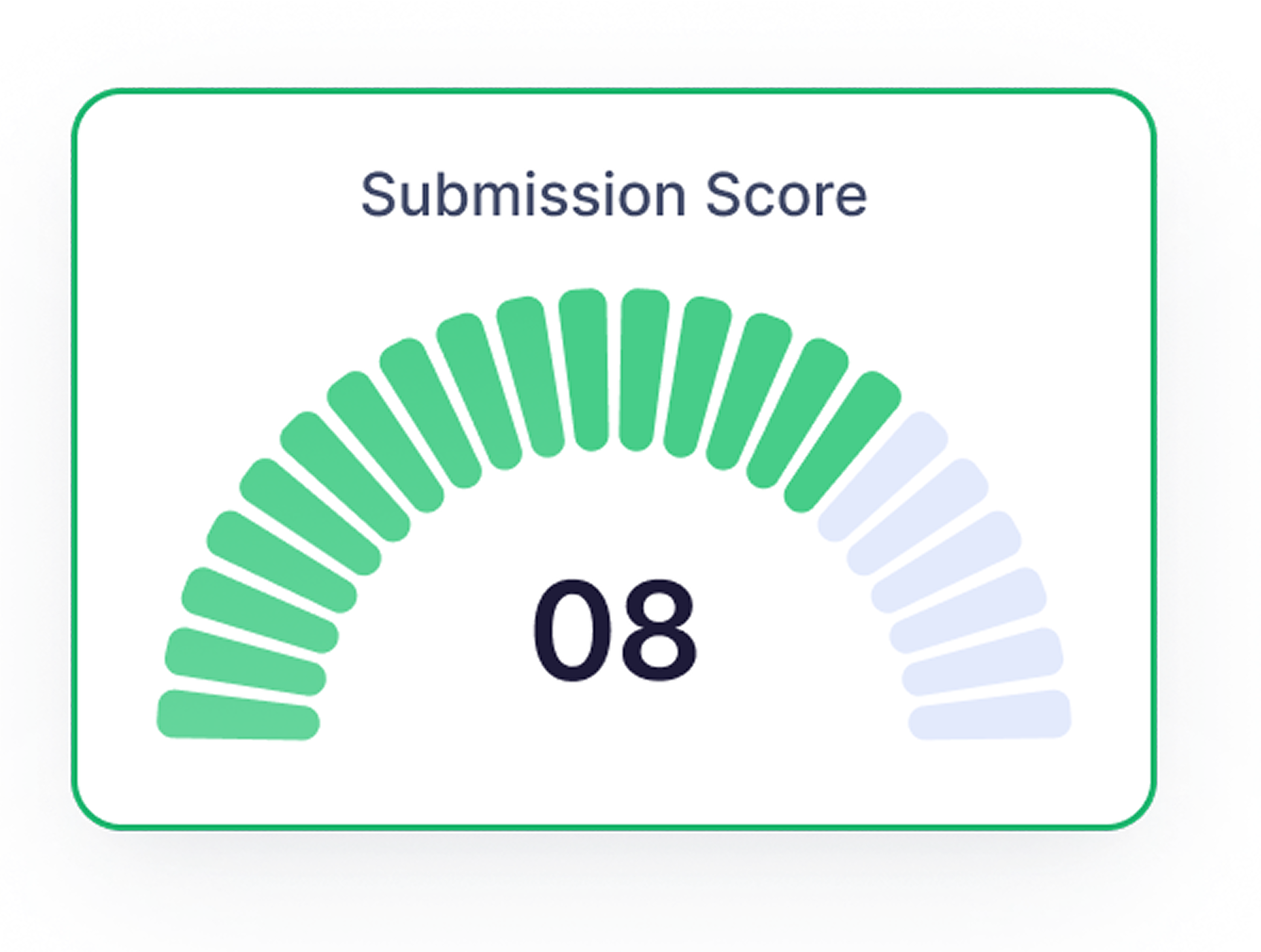

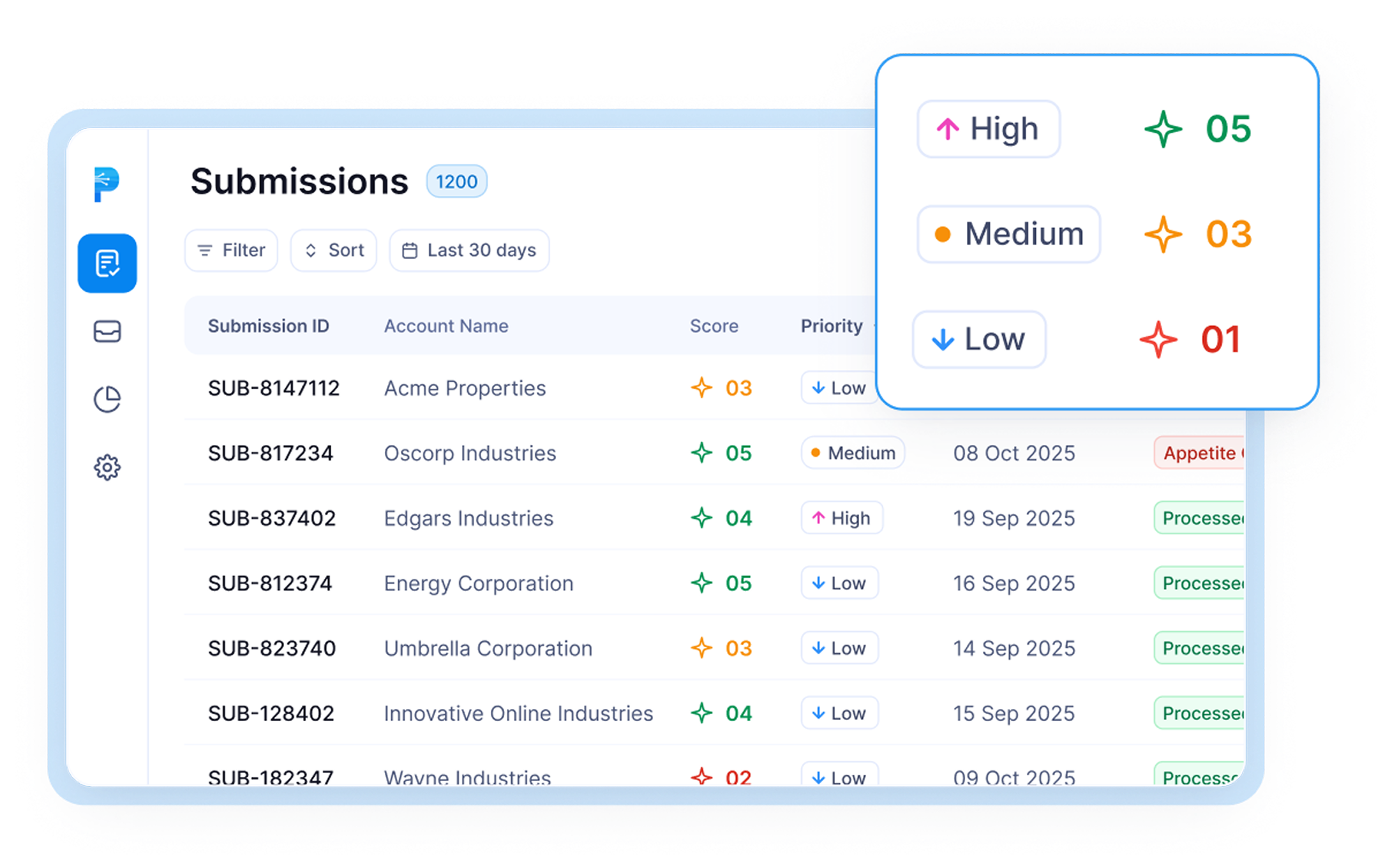

Score submissions fast

Submission prioratization and triaging

Score each submission against your appetite rules to quantify favorability.

Prioritize cases for immediate review based on score and signal intensity.

Recommend next steps to accelerate quote and bind decisions.

Reduce manual sorting and free underwriters to focus on judgment.

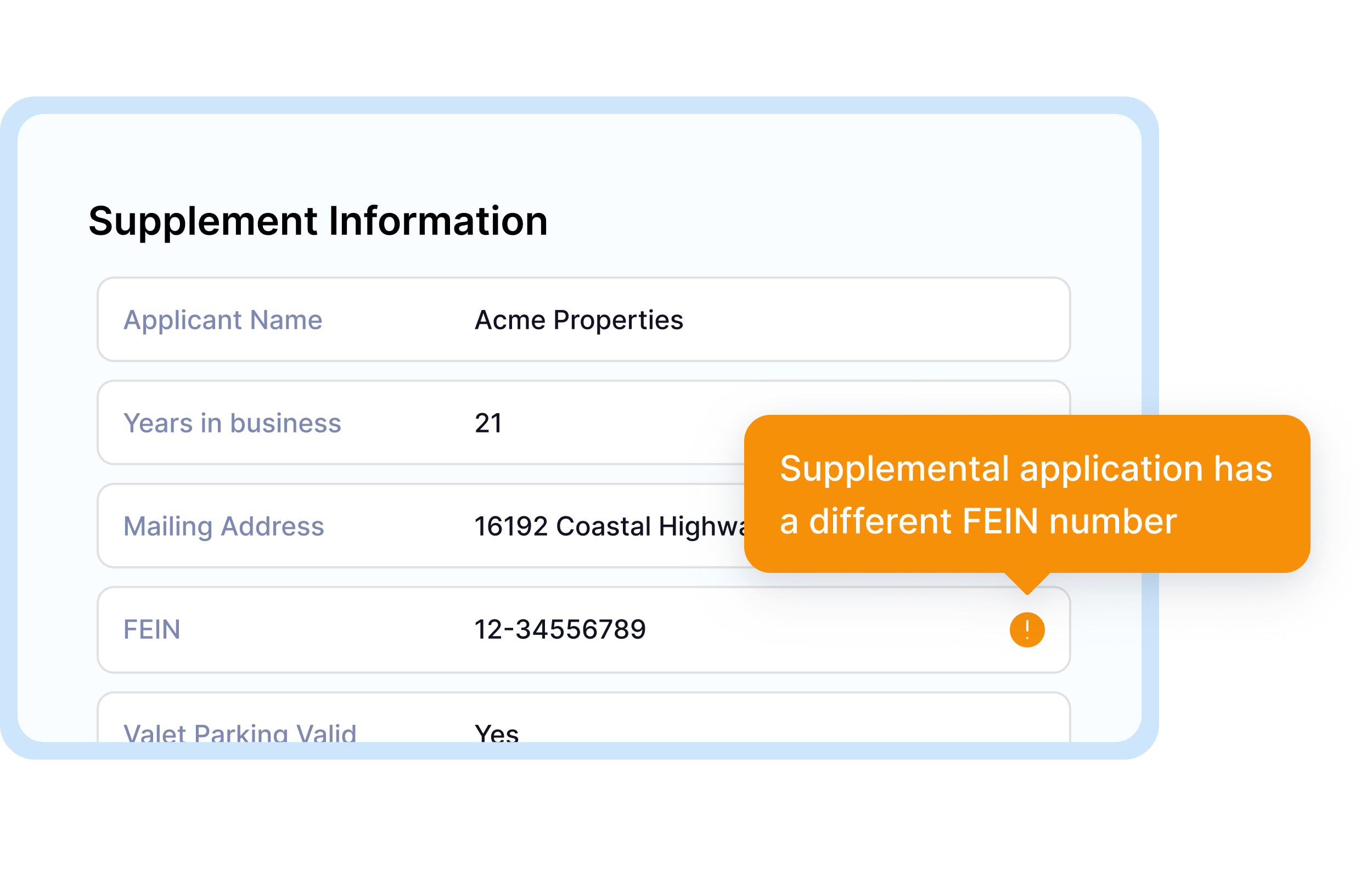

Verify across sources

Locate inconsistencies and confirm facts

Detect mismatches across documents and external sources automatically.

Validate critical fields against trusted records for higher fidelity.

Prioritize submissions based on combined external and internal signals.

Surface contradictory or outdated information for quick reconciliation.

85%

Faster Underwriting

32%

More GWP

700bps

Loss Ratio Improvement

Ironclad Data Security

Our commitment to data integrity is paramount, and we take pride in meticulously protecting your invaluable information. All customer data is housed in the US AWS regions on SOC 2 and ISO 27001 certified infrastructure to deliver the operational rigor enterprise teams expect. We encrypt data at rest with AES 256 and in transit with TLS 1.2, enforce least privilege through role based access controls, and defend applications with a web application firewall and AWS Shield. Comprehensive logs are retained for 90 days to enable rapid investigation and compliance, so you can move fast with absolute confidence.

Backed by

Member Of