The ultimate source of truth

The power of consolidating your underwriting journey like nothing else. Delivered in a single screen.

Flow that never stops

Automate setup and clearance

Expedite record creation and submission completeness checks.

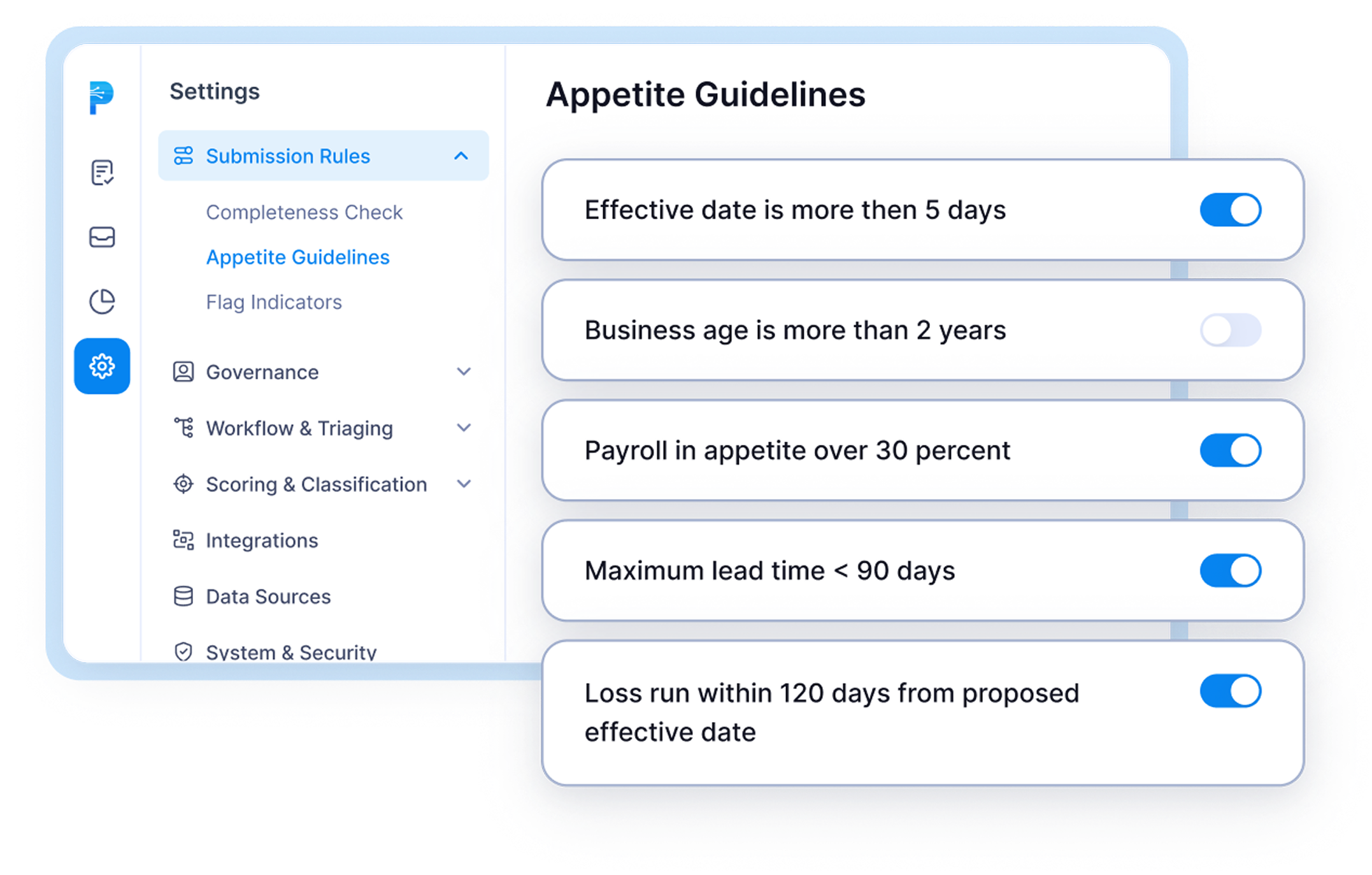

Validate appetite rules and flag exceptions instantly.

Remove duplicates and consolidate account data automatically.

Route cleared submissions to the right team instantly.

One console, total control

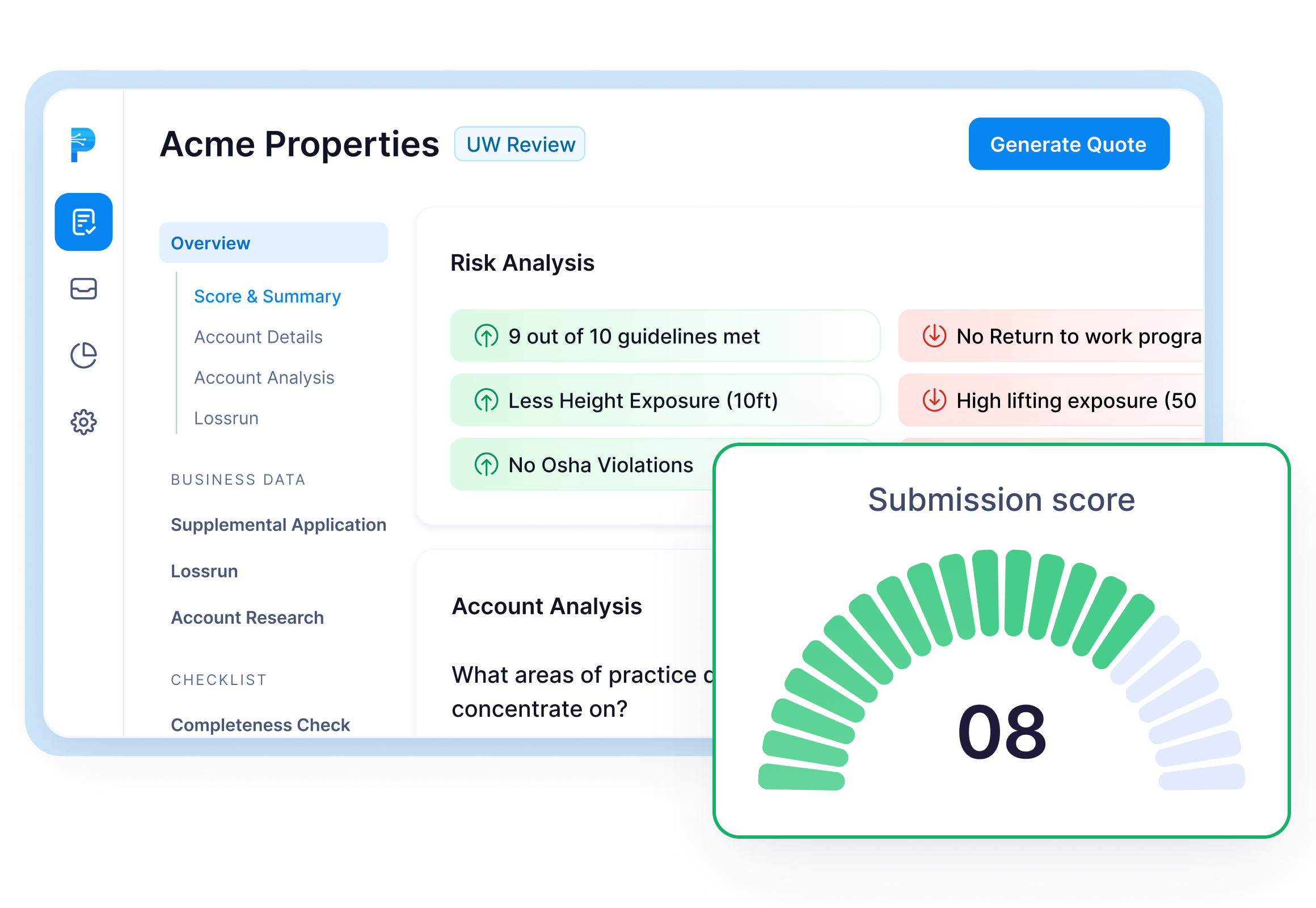

Unify disparate data points into useful information

Centralize summaries, account research, and risk signals into a single view.

Correlate documents, external context, and scores for faster decisions.

Configure role-based views for underwriters, operations, and leadership.

Sync outputs with policy admin and downstream systems seamlessly.

Ask anything at any point

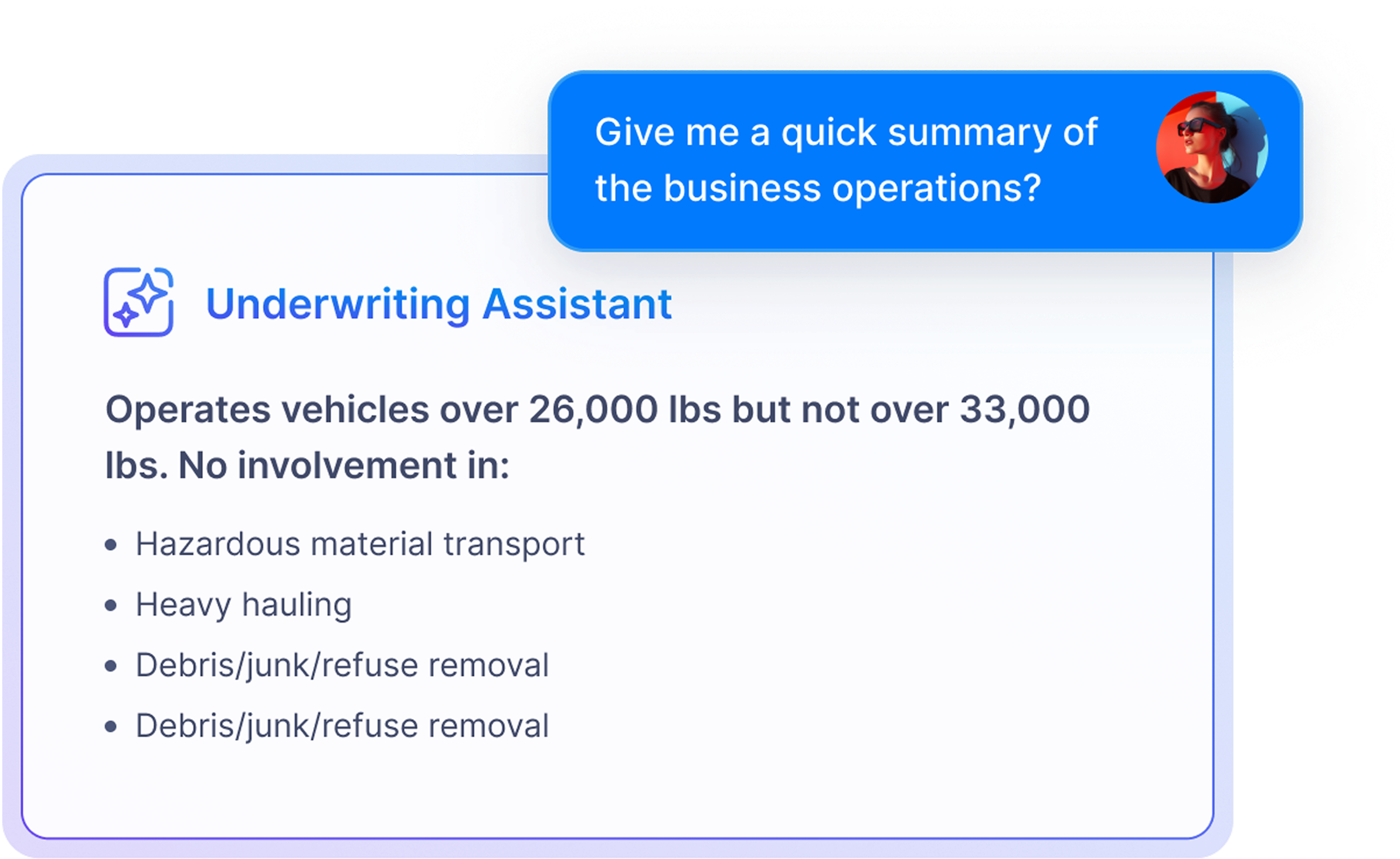

Submission GPT for instant answers

Query submission content in natural language and get concise, evidence-backed replies.

Extract key facts, timelines, and inconsistencies with a single question.

Generate next-step recommendations to accelerate quoting and binding actions.

Log Q&A to the submission record for audit and collaboration.

Prioritize what wins

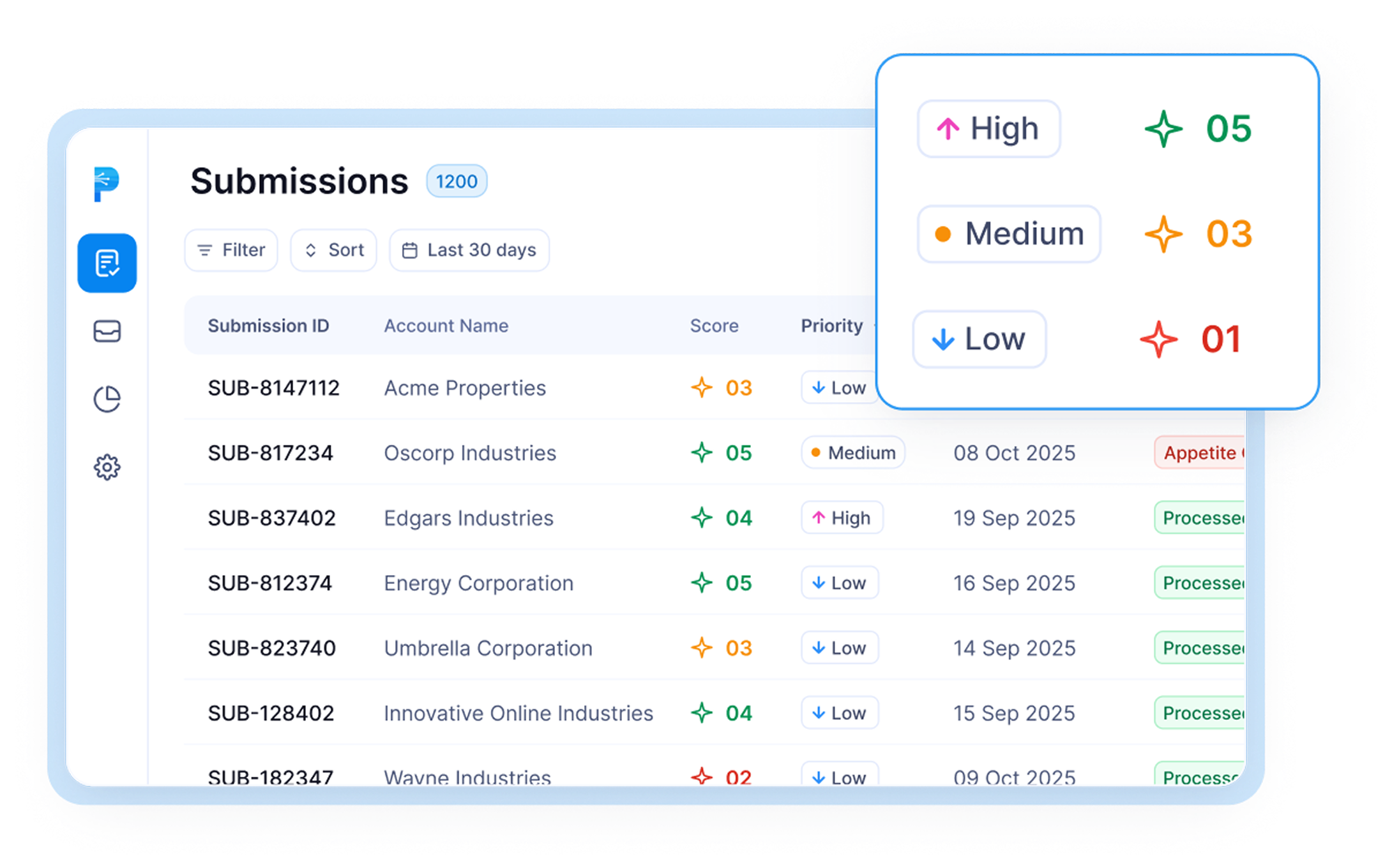

Triage and route with precision

Score submissions for favorability and appetite fit in real time.

Grade cases by score, urgency, or strategic value.

Assign work to the right underwriter or team based on rules and capacity.

Escalate exceptions and surface work that requires human judgment.

See performance, drive outcomes

Portfolio analytics and lifecycle tracking

Track submission lifecycle from intake to decision in real time.

Leverage 500+ pre-built templates or create your own dashboards.

Analyze hit ratio, time to quote, and contribution to GWP by segment.

Get alerts on portfolio drift and surface opportunities to optimize the book.

85%

Faster Underwriting

32%

More GWP

700bps

Loss Ratio Improvement

Ironclad Data Security

Our commitment to data integrity is paramount, and we take pride in meticulously protecting your invaluable information. All customer data is housed in the US AWS regions on SOC 2 and ISO 27001 certified infrastructure to deliver the operational rigor enterprise teams expect. We encrypt data at rest with AES 256 and in transit with TLS 1.2, enforce least privilege through role based access controls, and defend applications with a web application firewall and AWS Shield. Comprehensive logs are retained for 90 days to enable rapid investigation and compliance, so you can move fast with absolute confidence.

Backed by

Member Of